My post today has a bit of a theme to it, “New!” – not only is my first ever ‘interview’ blog, but I’m also taking things to a different corner of the EPM universe with Environmental, Social, and Governance reporting. (Don’t worry – there’s still my usual themes of data and governance woven in here!)

I began my “ESG journey” a little over a year ago, researching the components of ESG reporting and the different reporting standards and bench-marking organizations that comprised the landscape. In general, there’s a lot out there to learn! And it’s very fun to learn something new. I was also able to connect with my Huron ESG reporting colleagues to learn more about how we collected metrics and provided reporting from an ESG/Sustainability standpoint, as a publicly traded company. What I learned was that ESG reporting is much like financial & operational reporting: 1) data is difficult to collect, 2) data ownership is difficult to define, and the 3) process of putting it all together was A LOT of manual activity. Wheels started churning…

I assembled with a group of my Huron EPM colleagues (one of which you will ‘meet’ today in this post!) and we got to thinking – Oracle EPM solves a lot of these issues for organizations for financial and operational reporting, why couldn’t it be extendible to ESG reporting? We’ve solved other tough business issues with EPM; like Rate Case for energy and utilities, Clinical Trials for pharmaceuticals and life science, aging inventory solutions for CPG and retail – why couldn’t we use EPM for ESG?

Fast forward to February 2024, and Oracle proved they were also investing into this idea and released an Oracle EPM Toolkit for ESG. Currently, this toolkit supports a vast array of reporting frameworks (among them the large players: SASB, GRI, CSRD, CDP, TCFD) and is extendible for other frameworks or internal metrics.

A lot of our team’s research also included bench-marking Oracle EPM against other niche players in the ESG reporting market; and while these niche software vendors were able to solve the need; it became clear early that the extensibility of the Oracle cloud easily matched a lot of the functionality; and could maximize customer’s investment in the Oracle EPM Enterprise Bundle – not only is the software zero or minimally incremental license cost, but it also maximizing your organization’s investment in training and supporting the solution. Win-win.

I thought it would be a great opportunity for my friend and colleague, Ryan Hayes, to share his perspective on this topic – so we’re going to focus on why you shouldn’t overlook Sustainability Reporting and leveraging Oracle EPM Cloud could be the solution.

Oracle Barbie: Ryan first, thanks for coming on OracleBarbie.com, tell me about yourself and why you are engaged with the Oracle ESG initiative:

Ryan: My name is Ryan Hayes and I’m an Oracle Cloud EPM (Enterprise Performance Management) developer with 9 years of experience implementing EPM Planning solutions. I grew up in Michigan and then moved to Chicago for school, where I studied Finance and Economics at Loyola University Chicago. At Loyola, the Ignatian methodology is infused within all topics of study. That meant applying lenses such as ‘Social Equity’ and ‘Environmental Sustainability’ when thinking about business functions. I didn’t realize it at the time, but those lessons and experiences uniquely prepared me for working at the intersection of EPM and ESG.

Outside of work and education, I enjoy just about anything that involves being outdoors. From hiking, skiing, and camping in the mountains, to biking, golfing, and playing soccer around the city of Chicago. These passions contribute towards my enthusiasm for ensuring a more sustainable way of life for all.

The picture below goes with a quick story. My grandfather and his two brothers first hiked Mt. Washington in New Hampshire over 50 years ago. Since then, every Memorial Day weekend our family returns to continue the tradition. Between my grandfather and his two brothers, they had 13 children, which led to dozens of grandchildren (my generation), and now a rapidly growing 4th generation of great-grandchildren. I’m very grateful to be part of such a special tradition that helps me reconnect annually with my family and with nature. Below is a picture of myself from our most recent annual hike this past weekend (5/25/24), in front of one of the many waterfalls along Mt. Washington’s Ammonoosuc Ravine trail.

Oracle Barbie: To lay the foundation for this discussion, can you explain what is “ESG reporting”?

Ryan: Environmental, Social, and Governance reporting is the practice of publicly disclosing an organization’s performance regarding these categories. These three high-level categories expand to cover a wide range of data points and metrics, including: Greenhouse Gas Emissions (GHG), Energy Consumption, Waste and Water Management, Employee Health and Safety (EHS), Diversity Equity and Inclusion (DEI), and Supply Chain Management.

We are seeing people pay more and more attention to the actions of organizations, the decisions they make, and how those decisions impact our planet and society. Consumers, investors, and regulatory bodies are applying pressure in different ways for organizations to report on their sustainability practices and performance. Consumers are becoming more conscientious of the brands/products they support. Investors are increasingly incorporating ESG factors into their investment decisions, and governing bodies across the globe continue to push for new regulations that require ESG disclosures in standardized formats. ESG reporting is how organizations can respond to these external pressures and inform the public about their sustainability actions and results.

Oracle Barbie: I agree that this is an important and very complex topic, can you summarize why you think Oracle is investing into this ESG solution?

Ryan: ESG reporting is still a relatively new concept in the corporate world. However, in recent years there has been a shift towards requiring ESG reporting from organizations. Some of the factors that contribute to this trend include the following: growing awareness, regulatory pressure, and investor/consumer preferences. As organizations are pressured from all sides to report on their sustainability practices, we are likely to see ESG continue to increase in importance across all industries. Additionally, as the impacts of climate change continue to accelerate and intensify, ESG reporting will become that much more important in terms of holding organizations accountable for their contributions to GHG emissions.

As ESG reporting matures, I believe it will become a standard process within every organization, just as integral to operations (and the bottom line) as Finance, Sales, HR, IT, and Marketing. Oracle has a tremendous opportunity to expand their existing footprint in the Digital Information Systems market by providing their enterprise customers with end-to-end business process solutions, which now includes ESG performance management and reporting. Oracle Cloud is notorious for bringing together information from disparate sources and connecting stakeholders on a common platform; which truly aligns with solving some of the biggest pain points customers are currently facing related to ESG reporting.

Oracle Barbie: Can you explain how Oracle EPM enables compliance with various ESG frameworks and standards, such as GRI, SASB, or TCFD?

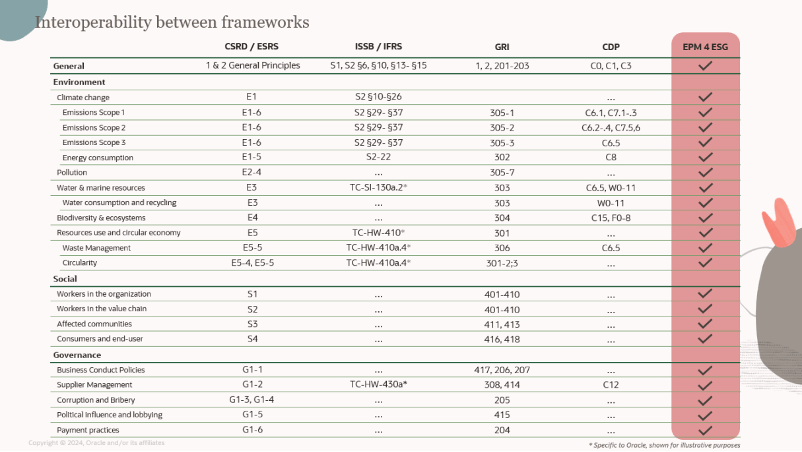

Ryan: The Oracle ESG solution includes a comprehensive ESG framework that is foundational within the application. Let’s call this primary framework ‘EPM 4 ESG’. The ‘EPM 4 ESG’ framework includes an array of ESG related criteria and is designed for scalability over time as ESG reporting requirements evolve. As reporting requirements and standards change and evolve, the flexibility of EPM Planning and the ‘EPM 4 ESG’ framework enables organizations to grow with them. New metrics and data points can be easily added to the ‘EPM 4 ESG’ framework and then dynamically mapped to regulatory frameworks, such as CSRD, GRI, SASB, TCFD and others to ensure that reports are up-to-date and in compliance with the latest regulatory requirements.

The ‘EPM 4 ESG’ framework serves as a single source of the truth for the other regulatory frameworks within the application. By dynamically mapping the ‘EPM 4 ESG’ framework to the various regulatory frameworks, the EPM solution supports ESG reporting across multiple frameworks with accuracy and ease.

(Picture of Oracle’s Framework Support)

Oracle Barbie: As you know; this blog is mainly focused on data integration, data governance, and master data. Can you walk us through the process of integrating ESG data into Oracle EPM, from data collection to report generation?

Ryan: Yes! Let’s talk data. ESG data can come from all parts of an organizations. It can be generated at different times, in various formats, and at many levels of granularity. Oracle’s ESG solution is built on the EPM Planning platform, which supports the collection of data in many ways, such as: direct integrations with source systems, flat file uploads, direct inputs forms, and business rule calculations within the application.

Using Oracle’s robust Data Integration capabilities, pull data in automatically from various sources, such as: ERP, Human Capital, Finance, Tax, and Supply Chain Management systems, even other EPM applications. These direct integrations can be automated and scheduled to ensure the ESG solution always includes the most up-to-date information. Integrations can also be configured for loading data from flat files. And if that is not enough, the solution also includes an assortment of ‘Sustainability Templates’, which enable direct input of ESG data for everything from GHG Emissions to Social and Governance type data as well.

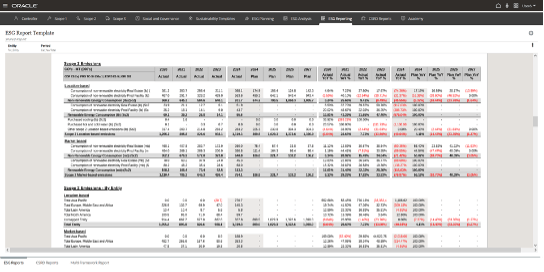

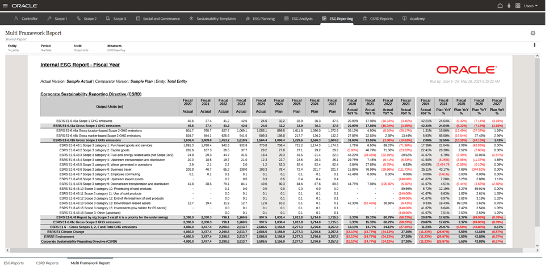

These data collection methods all serve the same purpose, and that is to populate the primary ‘EPM 4 ESG’ framework as completely and accurately as possible. This primary framework serves as a single source of the truth for reporting. The ‘EPM 4 ESG’ framework maps dynamically to regulatory frameworks, which can support reporting directly within EPM Planning, but can also support reporting elsewhere. EPM Planning can provide complete ESG data sets to Narrative Reporting or other reporting tools.

‘EPM 4 ESG’ Framework Report

‘Multi Framework Report’ (OOTB report supports CSRD, GRI, CDP, TCFD, SASB, and SEC)

Oracle Barbie: Great, another theme of Oracle Barbie is governance; can Oracle EPM help organizations identify ESG-related risks and opportunities, and how does it enable proactive decision-making in this regard?

Ryan: Oracle EPM Planning is a built on the multi-dimensional database formerly known as Essbase, which has a deep history of offering best-in-class analytical capabilities. Data stored in EPM can be pivoted, sliced and diced, aggregated, drilled down to the details, and even drill back to the source in some cases.

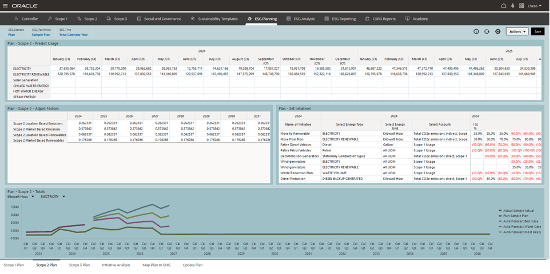

EPM Planning supports target setting, initiative planning, and what-if scenario modeling, which can be applied to ESG-related data in the same ways as with financial data. For example, plan for your organization’s transition to using renewable energy sources in place of non-renewables. What does that look like from an emissions reduction standpoint? What impact will it have financially? Oracle’s ESG solution can help answer these questions. Now add in Oracle’s Intelligent Process Mining (IPM) Insights and Predictive Planning capabilities and you have an extremely powerful tool for modeling trends/anomalies and understanding ESG data at a deeper level. Using EPM Insights and Predictive Planning can enable organizations to spend less time identifying important data points and more time making decisions around how address them.

Predictive Planning Models and Interactive Dashboards

I want to thank Ryan for contributing to Oracle Barbie and for providing these valuable insights on Sustainability reporting with Oracle EPM Cloud – looking forward unlocking the value it can provide in this arena.

Want to learn more? Ryan and I are going to go into even more depth on our upcoming speaking engagements this summer – join us virtually June 11th or in-person at ODTUG KScope24!

- June 11th: Virtual Webinar | Empowering Sustainability: Using Huron’s ESG Toolkit for Robust Reporting in the Oracle Cloud | 12PM ET / 9AM PT

- July 17th: ODTUG KScope24 in Nashville, TN | Nashville Notes on ESG: Tuning EPM for Sustainability and Success | 1:30PM ET (full schedule here)

Additional Oracle ESG resources:

- ESG—Environment, Social, and Governance | Oracle

- Does not require an Oracle sign in

- EPM for Sustainability Solution Release Information — Cloud Customer Connect (oracle.com)

- Requires Oracle.com sign in